This is Why E-Commerce Brands Are Opening Brick-and-Mortar Stores

In the last decade, the retail world has undergone major shifts with the rise of digital-first brands like Warby Parker, Bonobos, and Casper. These DTC startups created a “cut out the middleman” movement that many anticipated would spell the end of traditional retail storefronts.

So when Warby Parker decided to open its first storefront in 2013, analysts were understandably perplexed. Wasn’t brick-and-mortar retail supposed to be dead?

While many news headlines warn of an impending “Retail Apocalypse,” the actual numbers indicate a far different picture with 90% of purchases still being made in physical stores (see: Retail Apocalypse Debunked for more).

What’s more, other major DTC brands like Birchbox, ModCloth, UNTUCKit, Away, and Glossier would soon follow Warby Parker’s lead. And they’re not alone. Findings from a 2017 study by retail omnichannel platform Hero conclude that a staggering 67% of e-commerce brands that have received over $6M in funding have opened physical spaces in the past few years.

The fact that e-commerce-first brands are now turning to brick-and-mortar may be counterintuitive at first, but it shouldn’t be. Digital brands are simply capitalizing on what brick-and-mortar does best: offer instant gratification, engage all the senses, and offer expert advice.

I Want It Now: Stores Offer Instant Gratification and Promote Impulse Buys

No matter how fast Amazon can deliver, there’s still nothing faster than walking into a store and leaving 5 minutes later, product in hand.

Satisfying an increasingly “I want it now” generation of consumers is one of the main reasons that Amazon decided to open a chain of physical bookstores. And, according to its own customers, it seems to be working. In 2015, Vox writer Sarah Kliff visited Amazon’s newly opened Seattle bookstore. After half an hour of interviewing shoppers about why they decided to shop in the Amazon store as opposed to online, the most common phrase she heard was “instant gratification.” She writes: “The reason they decided to buy an item here versus online was simple: They could have it right now.”

Retail display company June20 conducted a recent survey of 1,000 US adult shoppers which revealed that 60.8% of consumers prefer in-store shopping because of the immediacy of the experience.

Another recent study of 2,000 US-based shoppers concluded that 54% of shoppers have abandoned an online shopping basket due to delivery costs and a quarter of them cancelled an existing order because the delivery wasn’t fast enough!

Online shopping is more convenient in some respects, but major brick-and-mortar retailers are quickly catching up to the advantages of e-commerce. Retail brands are unveiling digital-inspired initiatives like BOPIS (Buy Online Pickup In Store). By 2021, 90% of retailers are expected to offer a BOPIS option to their customers.

Fast home delivery for in-store purchases is also becoming more commonplace, and not just at grocery stores. Earlier this year, Target rolled out a home delivery option for its urban locations. For a $7 flat fee, Target shoppers in major cities can schedule a same-day delivery of their goods (because who likes to lug a 24 count of toilet paper rolls in public transit?). Similarly, Bed Bath & Beyond offers in-store shoppers in Manhattan free same day home delivery for $15.

There’s also a slew of retailers that have rolled out innovative solutions to eliminate the hassle of long checkout lines. From arming store associates with iPads that double as POS systems to accepting mobile payments through the retailer’s app.

And of course there’s the arrival of Amazon Go, the e-commerce giant’s new chain of cashierless stores that are poised to completely reinvent the grocery shopping experience.

Furthermore, if there’s one thing physical stores will always have the upper hand on it’s “impulse buys” (purchases that were not originally planned). A whopping 30 to 50 percent of all in-store purchases are considered impulse buys which equates to an average yearly spend of $5,400 per consumer (!) according to a recent Slickdeals study of 2,000 consumers.

Brick-and-mortar retailers truly excel at prompting shoppers to add just one more thing into their cart. From eye-catching signs promoting BOGO sales to high margin-low cost items strategically placed by the checkout line, retailers resort to a myriad of sales tactics to encourage spur-of-the-moment purchases.

Traditional Retail Harnesses the Power of Touch (& Our Other Senses Too)

One of the most common reasons shoppers choose in-store shopping over online is the ability to touch and feel products before they commit. TimeTrade’s 2017 retail report reveals that 72% of consumers preferred brick-and-mortar stores for this reason alone.

Apparel is obviously the main product category that consumers like to physically handle before purchasing, with 75% of all branded apparel purchases still being made in traditional stores. Furniture, jewelry and cosmetics are other retail categories that naturally benefit from haptic (tactile) feedback. Numerous psychology studies show that merely holding something in our hands increases our likelihood of buying it, reinforcing the power of touch over our purchasing decisions.

The power of touch is precisely why luxury bedding e-tailer Boll & Branch recently opened its first retail store inside a New Jersey mall. “The main reason a customer wouldn’t buy our product online was because they wanted to be able to feel it themselves,” says Boll & Branch co-founder and CEO Scott Tannen. “We are remedying that with our physical location.”

A physical store offers a holistic sensory experience that can simply never be replicated online. From Victoria’s Secret’s sexy pink and black hues to Anthropologie’s sweet signature scent (Volcano by Capri Blue – yes, you can buy it at the store), retailers have long relied on in-store branding and design elements to create a special experience for their customers.

That brings us to experiential retail. One of the buzziest trends in retail today, experiential marketing is a 360 degree sensory experience that allows consumers to experience brands at a deeper level. Experiential retail manifests itself in many forms. A department store can incorporate in-store spa and fitness services (Saks Fifth Avenue’s Wellery), a clothing brand can double as a coffee shop (Brooks Brothers’ Red Fleece Cafe), a kitchen supplies shop can lure in customers with fun cooking classes (Williams-Sonoma), and an athletic shoe brand can invite customers to test their sneakers in an in-store basketball court (Nike). The possibilities are endless.

Brick-and-mortar stores have a built-in opportunity to differentiate themselves from their e-commerce rivals by harnessing the senses of touch, smell, taste and sound. So make sure you ask yourself: what does my store smell like? How does it sound? Because these are some of the most important questions traditional storefronts need to be asking themselves today.

Can I Help You? Why Expert Advice Still Matters

One of the most frustrating aspects of online shopping is the lack of real-time help. Even though 44% of consumers say that having their questions answered by a live person while they shop online is one of the most important features a website can offer, the majority of e-commerce sites still haven’t implemented any live chat software.

Offering professional, courteous and fast customer service is thus one of the ways brick-and-mortar retailers can enjoy a clear advantage over their digital counterparts.

Consumer electronics, appliances, sports equipment and household goods in particular often require the expertise of a store associate who can guide consumers on product selection and answer important installation or configuration questions.

The retail categories that require the most store associate assistance (Source: Mindtree)

According to a 2016 survey by Mindtree, shoppers who interact with a sales associate are 43% more likely to purchase a product and their transactions have 81% more value, compared to those who don’t interact with a store associate. They’re also 12% more likely to revisit the store! In another study from business school INSEAD, retail sales associates with strong brand expertise sold 87% more than peers without!

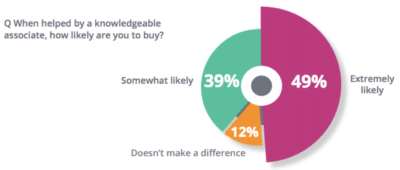

Source: TimeTrade’s 2017 State of Retail Report

Retailers must invest in training their floor staff to provide quick and experienced service to shoppers. Prompt service is the most valued service offering according to 47% of shoppers surveyed by TimeTrade in 2017. A live chat session on an e-commerce site simply cannot compete with the real-time assistance of a store associate with the right amount of experience to steer you in the right direction and boost your confidence in your purchase decision.

That’s why some of the most innovative retailers today are focused on delivering a service-oriented shopping experience. In October 2017, luxury retailer Nordstrom opened the first prototype of its new merchandise-free store concept in Los Angeles called Nordstrom Local. The 3,000 square foot store features personal stylists, a nail salon, a bar, tailoring services, and fitting rooms – but you can’t take any clothes home! Similar to a Bonobos guideshop, Nordstrom Local is a smaller-sized storefront with a singular goal: “Finding new ways to engage with customers on their terms.” Nordstrom has since expanded its Local shops to other locations.

Similarly, in July 2018, pet retailer Petco announced the launch of PetCoach, a store concept that does away with merch in favor of pet care. Its pilot store, located in San Marcos, CA, offers an impressive suite of pet care services including grooming, training, veterinary care, day care, self-wash, dog walking and educational events. They’ve even launched a membership program with perks like free vet visits and discounted goods and services.

Digital-first or “clicks and bricks” brands like Bonobos, Casper and Away are also calibrating their brick-and-mortar locations around service and experiences. That means having a smaller, more efficient physical footprint with a bigger attention around providing exceptional customer service and a memorable (or at the very least positive) experience.

Warby Parker’s Melrose Ave outpost is a prime example of this trend. Opened in 2017, the Warby Parker on Melrose is an homage to LA’s moviemaking history. In addition to its signature custom bookshelves stacked with eyewear, the Melrose store also features a Green Room, a green-screen-powered studio where shoppers can create mini videos posing in front of one of a dozen fun backdrops in a social-media friendly format.

Warby Parker’s Hollywood-themed outpost on Melrose Ave

“You keep hearing that brick-and-mortar stores are in trouble, that brands are closing stores, but it’s always been our view that shopping — particularly shopping for glasses, should be a fun, social experience,” says Warby Parker co-founder Dave Gilboa. “We want to give people a reason to come into the store.”

Brick-and-Mortar Retail Isn’t Going Anywhere

With all the hype around Amazon killing traditional retail, one might forget that the vast majority of transactions still happen in physical stores or that most larger digital-first brands have opened storefronts. The attention-grabbing headlines aren’t revealing the full picture of the retail industry. If anything, traditional retail is validated – nay, vindicated! – by e-commerce brands.

With digital-first brands increasingly using their funding to open physical locations, stores have gone from representing a liability to an asset. E-commerce sites are turning to brick-and-mortar retail, with its real-world experiences, to build out their businesses and scale faster.

Beyond representing an opportunity to gain new customers, traditional storefronts possess core advantages that digital commerce lacks – namely instant gratification, sensory stimulation, and real-time expertise. A brick-and-mortar presence is clearly an important, if not essential, part of the digital store’s ecosystem. By optimizing those three core areas for maximum impact and success, retailers can stop worrying about the “Amazon effect” and start growing their base.